December has arrived, bringing winter's chill to the housing market and the final real estate update of 2025.

In this recap, we'll cover recent sales and pricing trends, shifting buyer dynamics, and what the numbers mean if you're thinking about buying or selling in the new year.

What You Need to Know Right Now

Are prices going up or down?

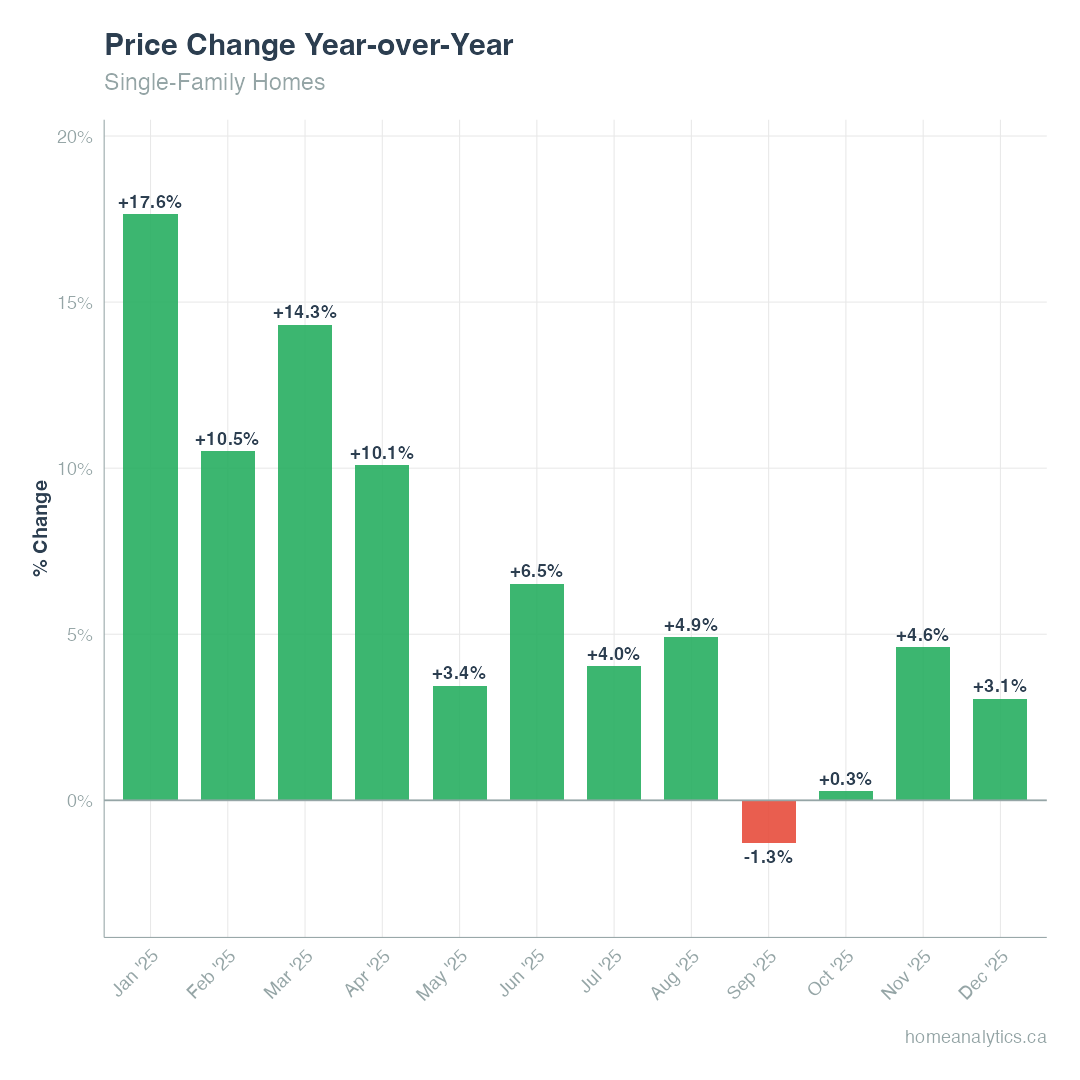

Prices are holding relatively stable. Single-family detached homes sold for a median of $499,000 in December, down just 1.2% from November. Year-over-year, prices are still up 2%.

Is now a good time to buy?

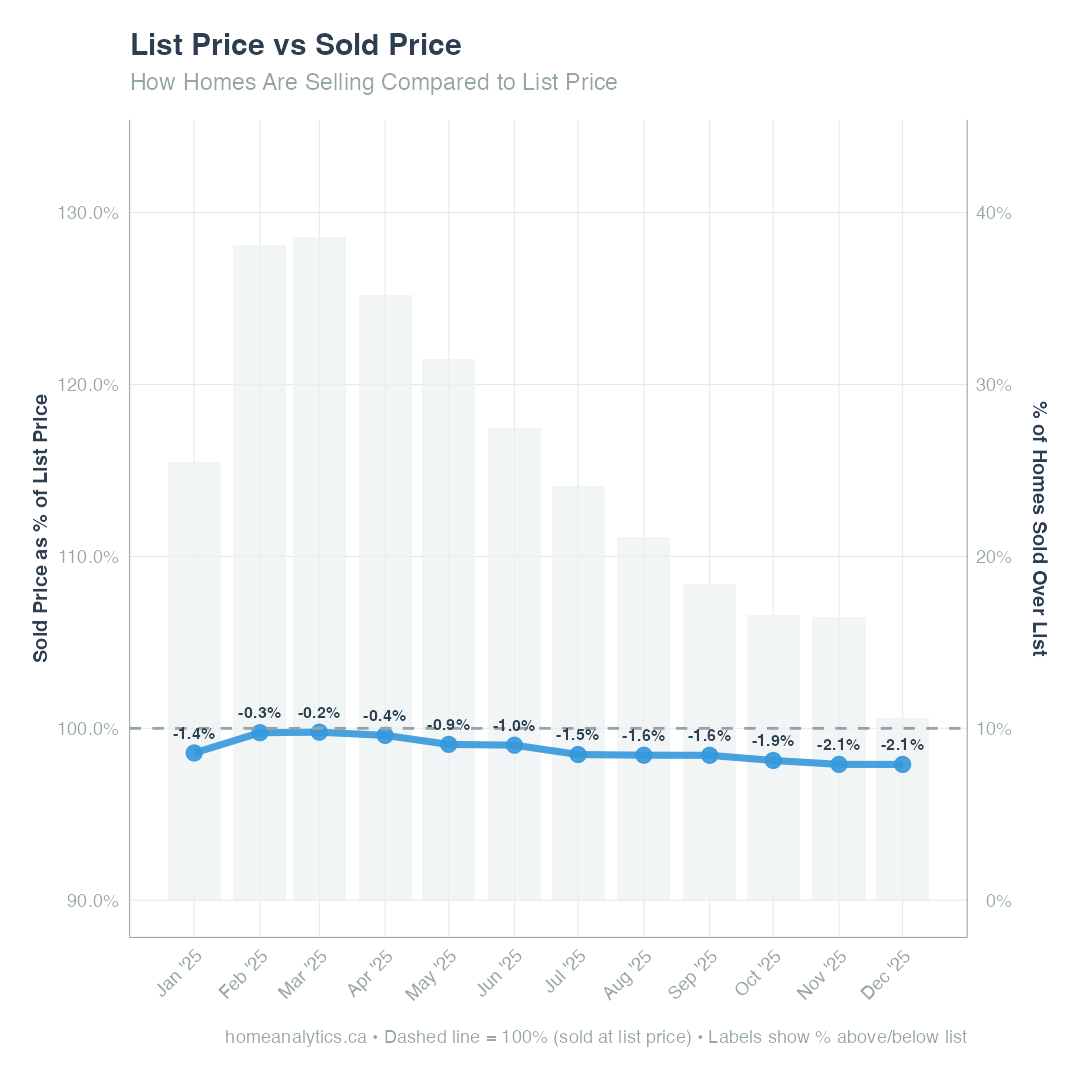

Yes. Buyers have more negotiating power than they've had in months. With 84% of homes selling below list price and inventory growing, you're in a stronger position to make offers that work for your budget.

Are homes sitting on the market longer?

Somewhat. The typical single-family home spent 40 days on the market in December. That's up from the spring, but still reasonable. Only 11% of homes sold above asking price last month.

What about inventory?

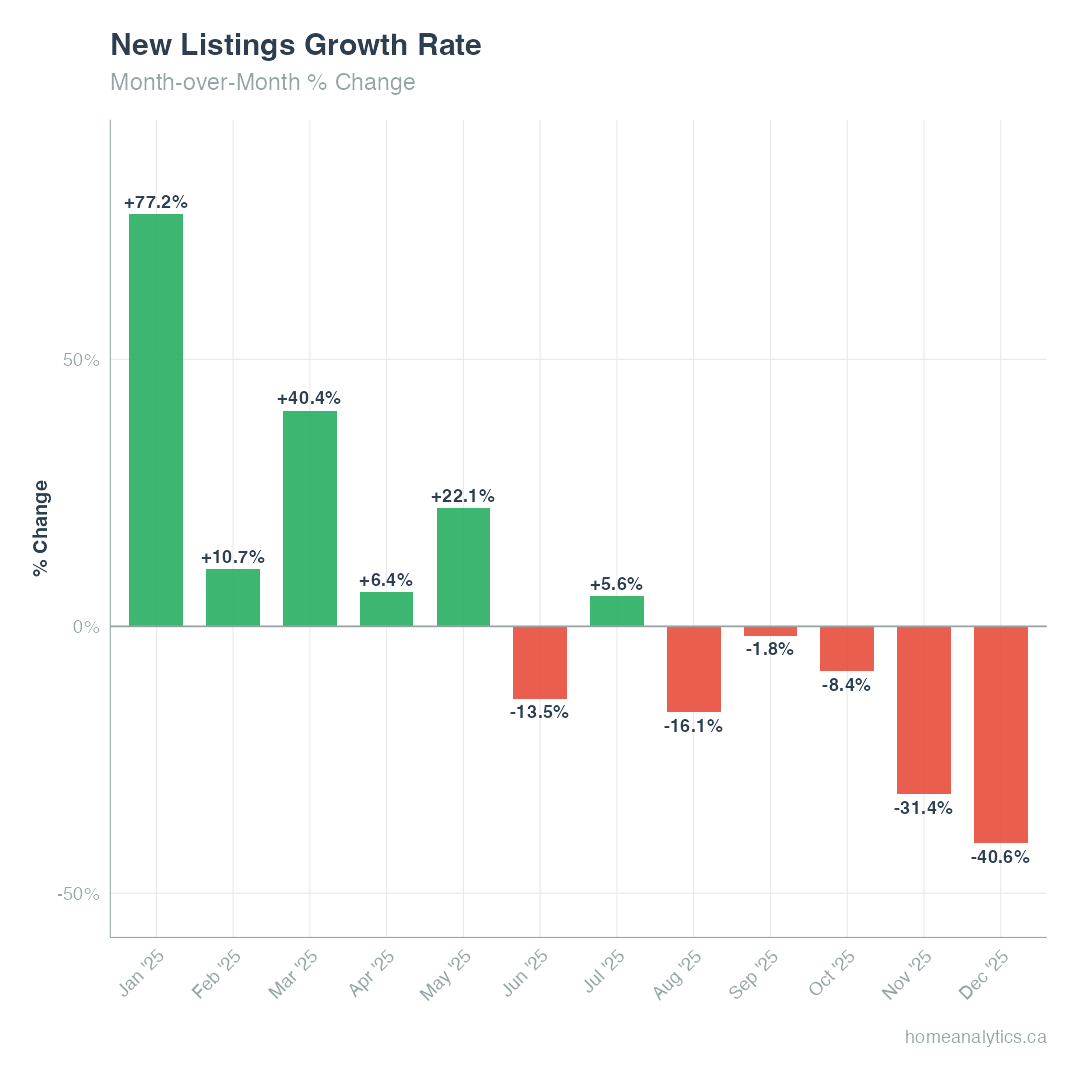

New listings dropped sharply in December (down 40.6% from November), but that's typical for winter. Year-over-year, inventory is up 11.6%, giving buyers more options.

Sales Activity: A Cooling Market

Home sales in Edmonton have fallen to their lowest seasonal level in recent months, reflecting the combined impact of winter conditions and economic uncertainty.

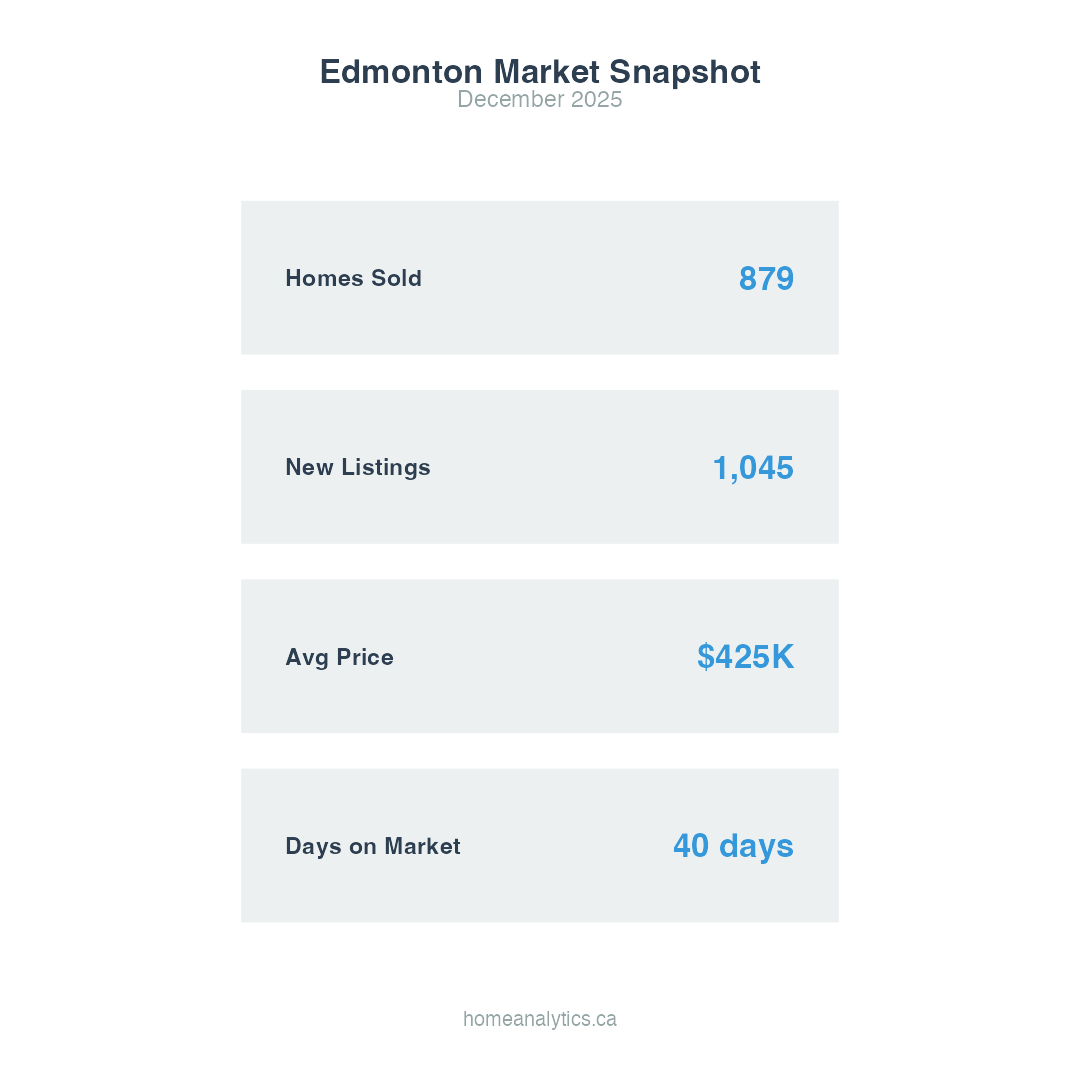

In December, the total number of homes sold in Edmonton was 879, which was 25.2% lower than in November. Year-over-year, sales were down 15.3%.

Single-family detached home sales in December were down 24% over the previous month, while new listings fell 40.6%. This seasonal slowdown is expected, but the year-over-year trends reveal a broader shift in buyer behavior.

Pending home sales—homes under contract—fell 15.3% compared with last year, as economic caution weighed on buyers.

For the full year, Edmonton saw 17,824 total sales in 2025, compared to 19,905 in 2024, a decline of 10.5%.

Pricing: Modest Adjustments Across Property Types

The average selling price saw a small dip of 0.3% to $546,680 in December, while it remained relatively flat month-over-month, seasonally adjusted.

The average price for a single-family detached home in Edmonton was $499,000 in December, down 1.2% from November but up 2% from the same month last year.

Last month's median single-family home price was $499,000, which reflects steady demand despite slower sales activity.

Home sale prices were up 3.1% from December of 2024 and were 2% higher for the median price than in the same period of last year.

The median price for both houses and condos has declined modestly for the second consecutive month, reinforcing the shift toward more balanced market conditions.

Prices of Other property Types:

Half-duplex: Average price of $440,608 (up 1% month-over-month, up 6% year-over-year)

Condos: Average price of $196,103 (down 3.2% month-over-month, down 3.5% year-over-year)

Townhomes: Average price of $271,375 (up 1% month-over-month, up 1.6% year-over-year)

For buyers, this means the Southwest Edmonton market and Southeast Edmonton neighborhoods are offering competitive pricing across multiple property types.

Inventory: Growing Supply Favors Buyers

The inventory of homes for sale rose 11.6% year over year, marking continued inventory growth into the winter months.

Active listings for single-family homes remain above historical averages, giving buyers increased choice and greater buying power.

New listings were down by 40.6% in December compared to November—a typical seasonal pattern—but the overall supply picture remains favorable for buyers entering 2026.

The number of homes available for sale at the end of the month, or active listings, was up significantly over last year across Northwest Edmonton and Northeast Edmonton zones.

Days on Market: Homes Taking Longer to Sell

Homes spent a median of 40 days on the market in December, reflecting softer competition compared to the spring selling season.

In December, the typical home spent 40 days on the market, which is longer than the same time last year when properties moved faster.

This marks the continuation of homes taking longer to sell on a year-over-year basis, particularly in the luxury single-family home segment.

For sellers, this means pricing strategy and presentation matter more than ever.

Market Conditions: A Strong Seller's Market (But Shifting)

With costs of borrowing stabilizing and home prices adjusting modestly over the last twelve months, the market is currently benefiting buyers who are patient and strategic.

Sellers are facing longer listing times and increased competition, while buyers have more leverage than they've had in years.

The share of single-family homes selling for more than the owner's list price decreased to 11% in December—the lowest share for any December in recent years.

84% of listings sold below asking price, giving buyers room to negotiate. Only 11% of homes received offers above list price.

The sales-to-listings ratio for December was 0.84, indicating a seller's market. For every 10 new listings, 8 are selling, a strong competition for buyers, but not the feeding frenzy of 2021–2022.

Unless there is a material improvement in the broader economic outlook, particularly with greater clarity around interest rate policy—this cautious tone is likely to continue into early 2026.

Months of Inventory: Balanced Conditions Emerging

The current balance between supply and demand is reflected in the months of inventory (MOI), which measures inventory relative to the number of sales each month.

In December, the MOI for Edmonton increased slightly to 1.2 months.

A balanced market (a market where prices are neither rising nor falling) is one where MOI is between four to six months. Edmonton remains below that threshold, but inventory is growing.

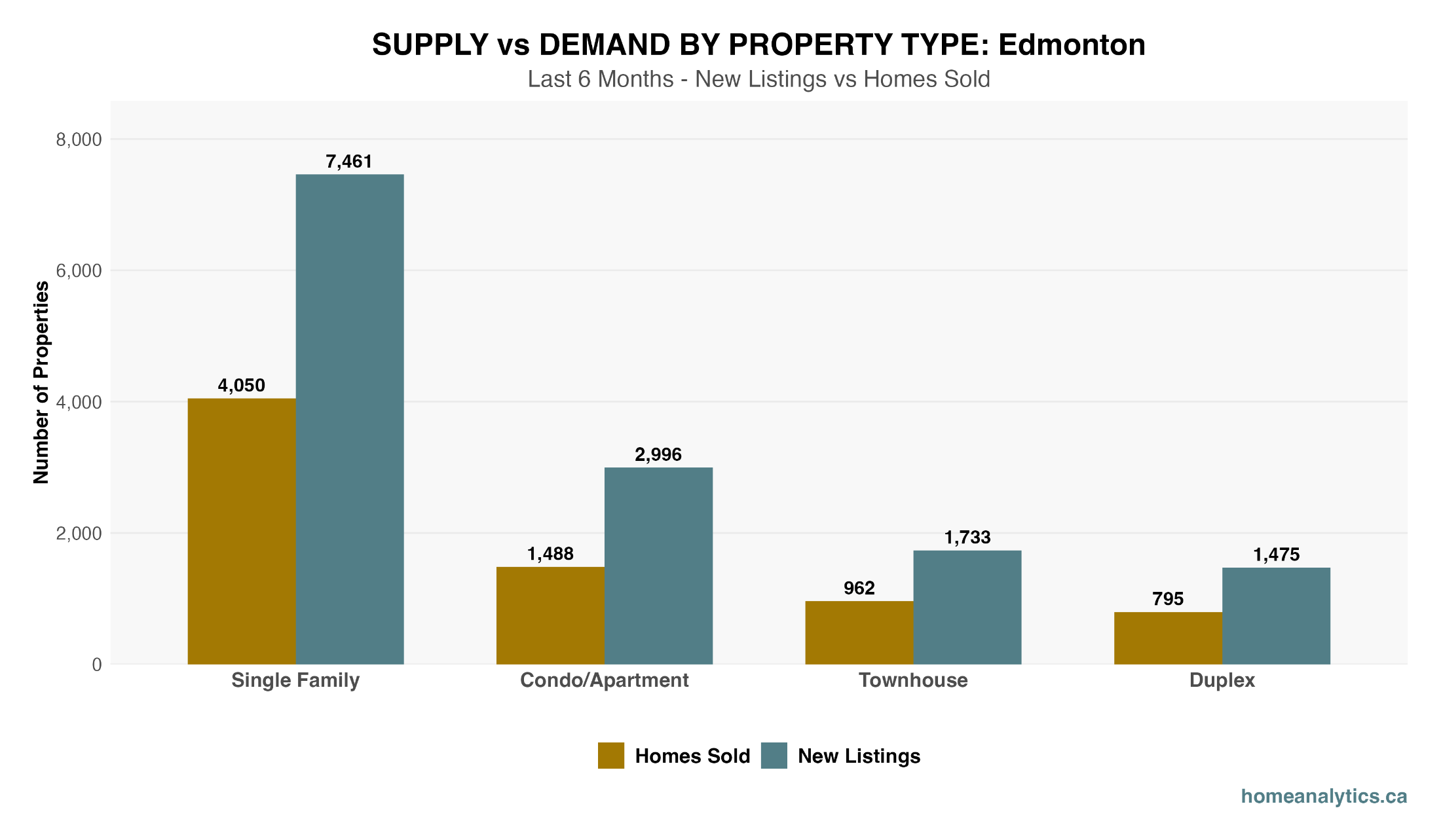

Supply and demand by Property Type (6-month average):

Townhouse: Sales ratio of 0.56 (balanced market, most competitive segment)

Single-family: Sales ratio of 0.54 (balanced market)

Duplex: Sales ratio of 0.54 (balanced market)

Condo/Apartment: Sales ratio of 0.50 (balanced market, more buyer-friendly)

Buyers looking at no-condo-fee townhomes or half-duplex properties will find the most balanced conditions.

Economic Context: Caution and Opportunity

Amid current interest rate uncertainty, slowing market conditions in major Canadian metros, and the upcoming federal election, many households are thoughtfully timing their home buying and selling decisions.

Buyers and sellers in Edmonton are proceeding with confidence and well-informed foresight, supported by Alberta's stronger economic fundamentals compared to other provinces.

Canada's two largest housing markets are experiencing significant corrections that are reshaping buyer expectations nationwide.

Toronto home sales fell 8.2% year-over-year in late 2025, with average prices down 4.1% from their peak. Vancouver saw similar declines, with detached home sales dropping 12.7% and benchmark prices falling 6.3% in the same period.

This cooling in Canada's most expensive markets is creating a ripple effect. Buyers who previously felt priced out of Toronto and Vancouver are now reassessing their options and Edmonton is increasingly on their radar.

Affordability continues to be the key issue shaping the Edmonton housing market. The median buyer is facing higher monthly costs due to elevated interest rates, even as prices moderate.

To afford a median-priced home in December, a household needed to earn about $110,000 per year (assuming a 10% down payment and current mortgage rates around 4.8%).

These figures support the forecast that continued price stabilization is necessary to restore transaction volume to healthy, pre-pandemic levels.

Price Per Square Foot: What You're Really Paying

Price per square foot is one of the most reliable ways to compare value across different home sizes and neighborhoods.

In December, the median price per square foot for single-family homes was $318 up just 0.5% ($2/sq.ft) from a year ago.

Home Prices by home size:

Under 1,000 sq.ft: $361,000 median (943 homes sold)

1,000–1,500 sq.ft: $442,000 median (3,314 homes sold) — most active size range

1,500–2,000 sq.ft: $537,500 median (2,414 homes sold)

2,000–2,500 sq.ft: $632,000 median (1,723 homes sold)

2,500–3,000 sq.ft: $785,000 median (512 homes sold)

3,000+ sq.ft: $1,211,500 median (224 homes sold)

The 1,000–1,500 sq.ft range remains the sweet spot for buyers in Edmonton, offering the best combination of affordability and availability.

Use our interactive map search to explore homes by size and price across all Edmonton zones.

Neighbourhood Highlight: Strathcona

Strathcona continues to be one of Edmonton's most dynamic and sought-after neighborhoods, blending historic character with modern urban living.

In the past six months, Strathcona recorded 22 single-family home sales at a median price of $580,000, a 7.4% premium over Edmonton's citywide median of $499,000. This premium reflects the neighborhood's proximity to the University of Alberta, Whyte Avenue's vibrant commercial corridor, and the Old Strathcona Farmers' Market.

Homes in Strathcona are moving quickly, with a median time on market of just 21 days, nearly half the citywide average of 40 days. This rapid absorption rate signals strong buyer competition, particularly for well-maintained character homes and renovated properties near key amenities.

Price per square foot in Strathcona averaged $358/sq.ft, compared to the Edmonton average of $318/sq.ft. Buyers are paying a premium for location, walkability, and the cultural cachet of living in one of the city's most established communities.

Forward-Looking: What to Expect in 2026

The Edmonton real estate market closed 2025 with a clear message: this is a transitional year favoring informed, strategic participants. Buyers have gained negotiating power as inventory grows and competition eases, while sellers who price competitively and market effectively are still achieving strong results.

The Edmonton residential market is well-positioned for long-term growth, supported by population growth, diversified employment, and relatively affordable housing compared to other major Canadian cities.

While 2026 may be a year of normalization, Edmonton's economic resilience, demographic growth, and housing fundamentals continue to make it one of the most attractive housing markets in Canada.

Ready to make your move?

Use our net proceeds calculator to see what you'll walk away with when you sell, or explore the 2023 Edmonton zone map to find your next neighborhood.

For sellers: Check out our guide on the best time of year to sell a house in Alberta and learn how much it costs to sell your house in Alberta.

For buyers: Browse luxury condos for sale in Edmonton or explore St. Albert single-family homes.

.png)