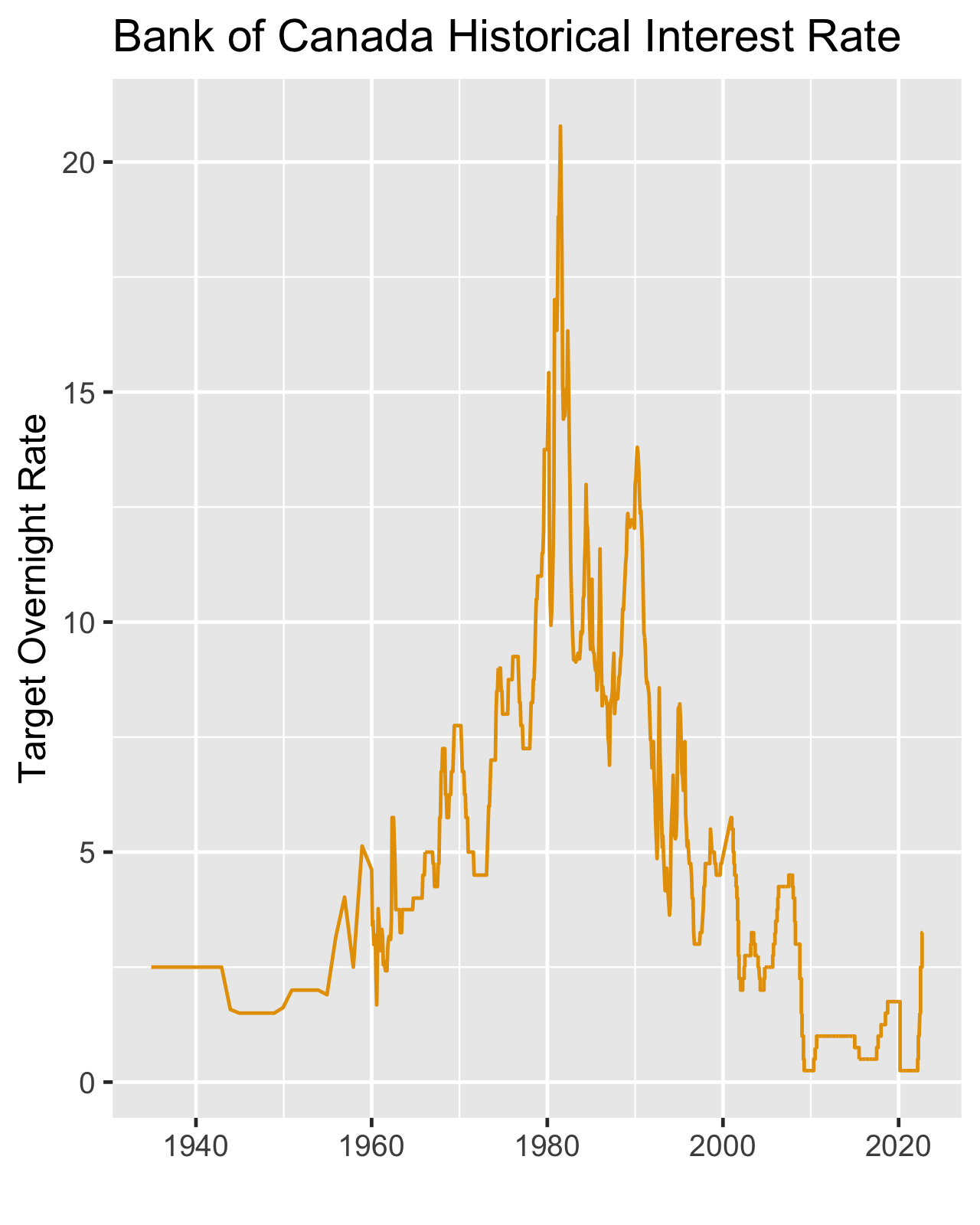

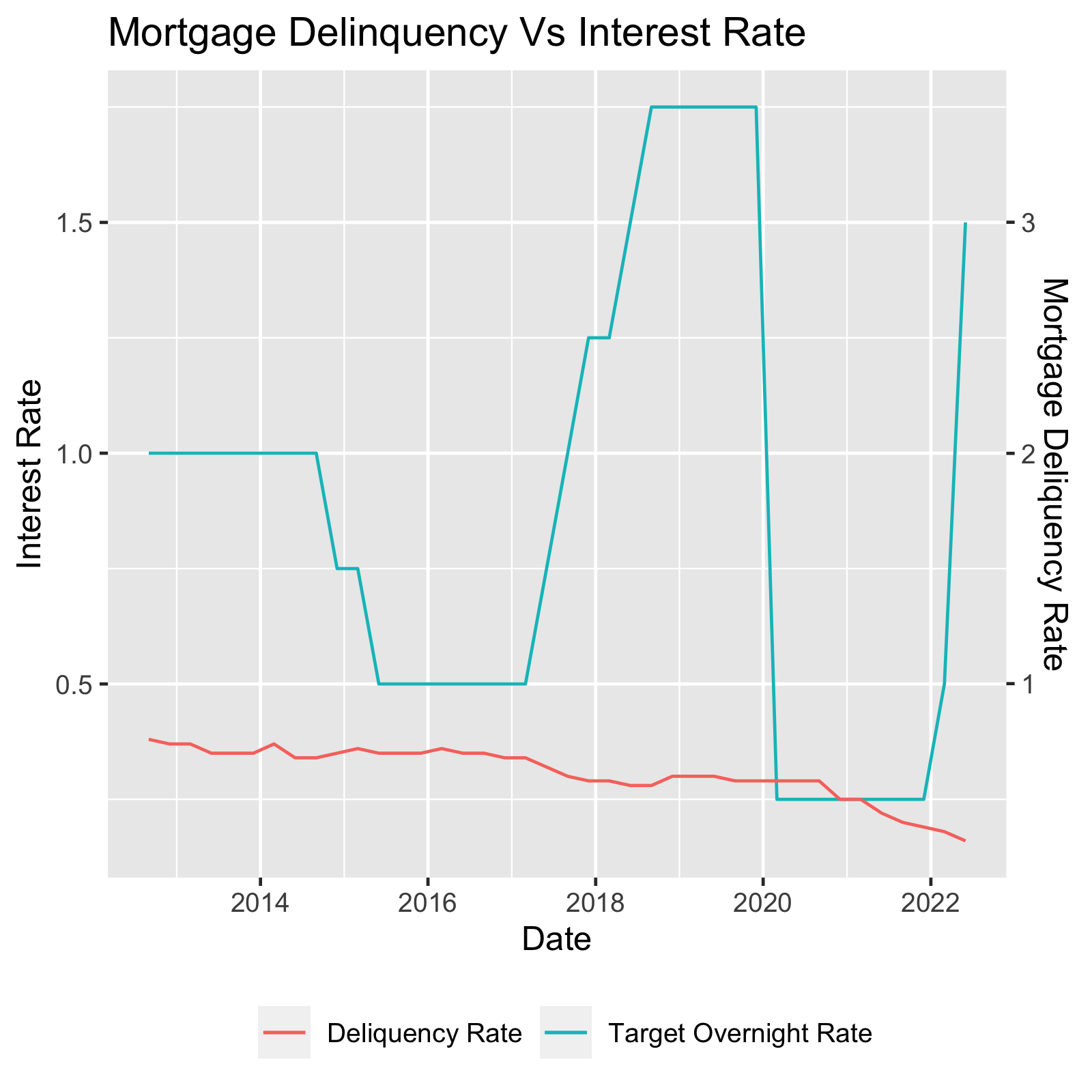

The interest rates in Canada have been on the rise since the beginning of this year, increasing from a low of 0.25% to a high of 3.25%. The last time the rates were this high was back in 2007-2008 following the global financial crisis. At these higher rates, consumers and businesses are paying more in borrowing costs, which can impact their ability to invest or purchase products. There are two additional interest rate announcements scheduled before the end of the year (October 26th and Dec 07th) which could potentially further increase borrowing costs.

Even with the rising interest rates, the mortgage delinquency rates in Canada have been steadily dropping for the past few months, with the latest numbers for Q2 being at 0.16%. This downward trend is good news for both homeowners and the Canadian economy as a whole. However, at the end of Q2, the Bank of Canada's overnight rate was only at 1.25%, and sit has since risen to 3.25%. It will be interesting to see how the Q3 Q4 rate hikes will affect overall mortgage delinquency rates in Canada.

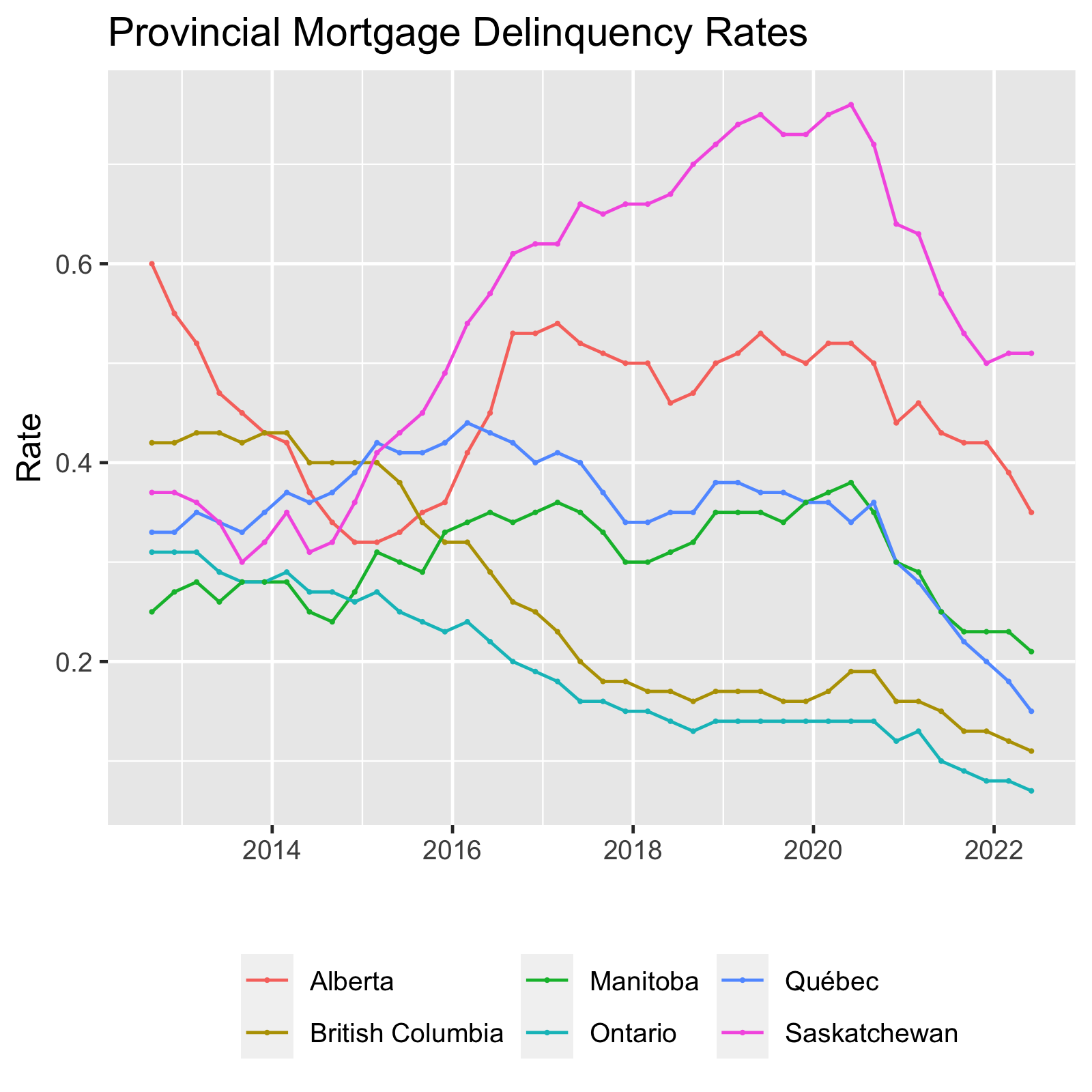

Provincial mortgage delinquency rates

At the top of the list, we see that Saskatchewan has the highest mortgage delinquency rate of 0.51%. Second is Alberta at 0.35% followed by Manitoba at 0.21%. Despite having some of the highest costs of living and housing prices in the country, provinces like Ontario, British Columbia and Quebec have some of the lowest delinquency rates of 0.07%, 0.11% and 0.15%, respectively. This suggests that even in cities with high housing costs, residents are still able to manage their finances effectively and stay on top of their mortgage payments.

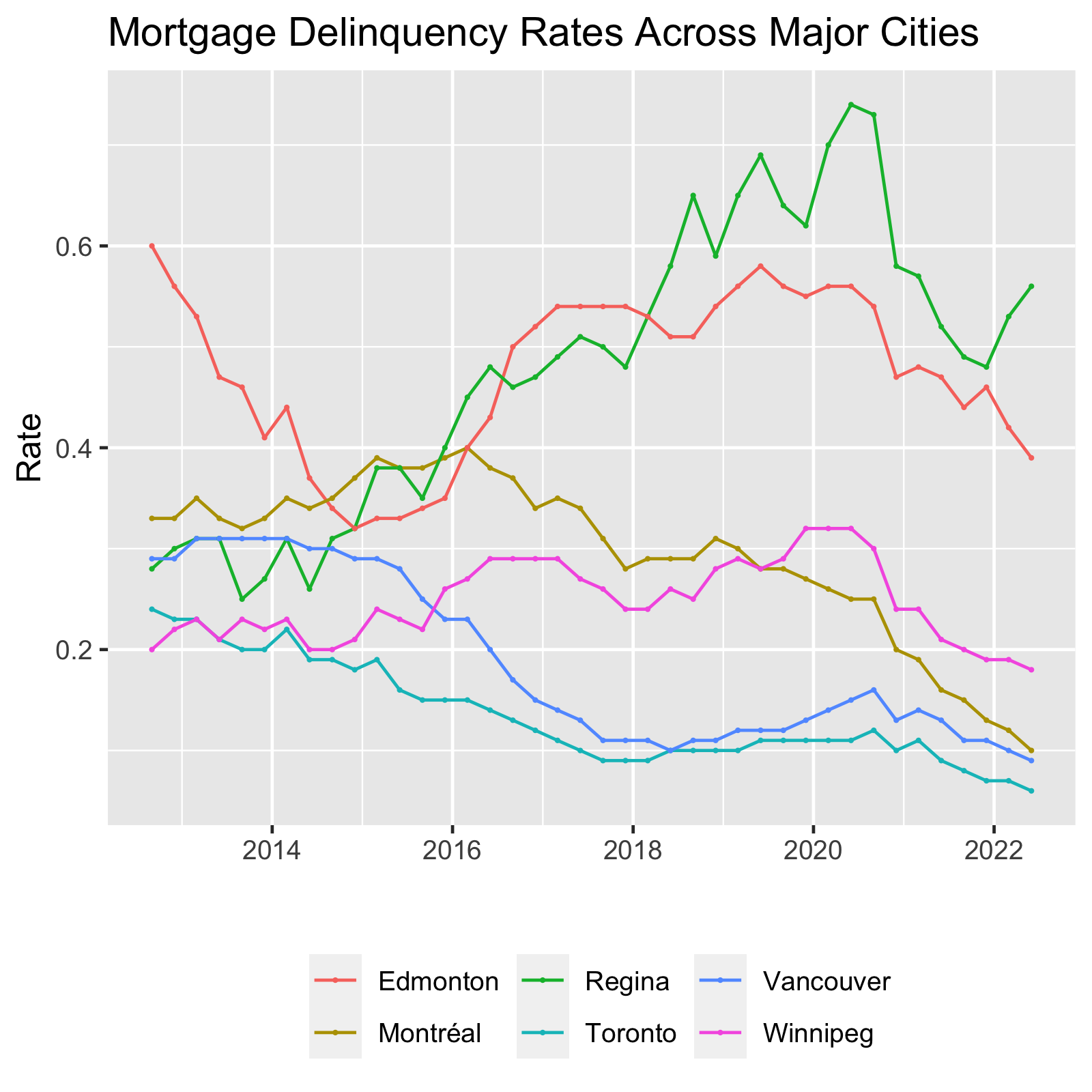

Mortgage delinquency rates for 6 major Canadian cities

Across Canada, the cities with the highest mortgage delinquency rates are Regina at 0.56%, Edmonton at 0.39%, and Winnipeg at 0.18%. These rates are significantly higher than those in major cities like Toronto, Vancouver and Montreal which have delinquency rates of just 0.06%, 0.09% and 0.10%, respectively.

How do rising rates affect mortgage Delinquency rates?

While rising interest rates could make it more difficult for Canadian consumers to make their mortgage payments, there is no clear relationship between rising interest rates and mortgage delinquency rates. It will be important to keep an eye on the mortgage delinquency rates moving forward to identify any potential risks or trends that may impact the Canadian housing market.

For homeowners who may be struggling with higher interest rates

One solution for homeowners who may be struggling with higher interest rates is to switch to a fixed-rate mortgage. This will lock in your interest rate for a set period, which can provide some stability and predictability in your monthly payments. Additionally, responsible use of your credit card or line of credit can help you stay ahead of any potential financial challenges. Finally, you could also consider selling your home and moving to a smaller or more affordable one. Whatever option you choose, it's important to seek help if you're struggling with your payments. There are many resources available to help you, including credit counseling services and debt management plans.

Homeowners need to stay informed about current interest rates and how they may affect their borrowing costs. By keeping abreast of these market trends, Canadians can make more informed financial decisions and better manage their finances over time.

What is mortgage delinquency rate?

Delinquency refers to the state of being late on mortgage payments for a given period, usually 90 days. Mortgage delinquency rate is measured as a percentage, calculated by dividing the total number of loans that are delinquent by the total number of loans held by an institution.

.png)

.png?cc=1666309770129)